The management of inventory is crucial for any business, especially when it comes to understanding how quickly inventory is being sold and replenished. A key metric for evaluating this aspect is the Days Sales in Inventory (DSI), which provides valuable insights into the operational efficiency of a company’s inventory system. In this article, we will explore the Days Sales in Inventory formula, its significance, how to calculate it, and how businesses can use this metric to improve their operations.

What are Days Sales in Inventory?

Days Sales in Inventory (DSI) refers to the average number of days a company takes to sell its entire inventory during a specific period, such as a year or quarter. This metric is a critical measure of how well a company is managing its inventory levels and turnover. A lower DSI typically suggests that a company is efficiently turning over its stock, whereas a higher DSI indicates slower sales or potential issues with inventory management.

DSI is especially relevant for industries with high volumes of inventory turnover, such as retail, manufacturing, and wholesale. By understanding DSI, businesses can better align their production, purchasing, and sales strategies to avoid stockouts or excess inventory.

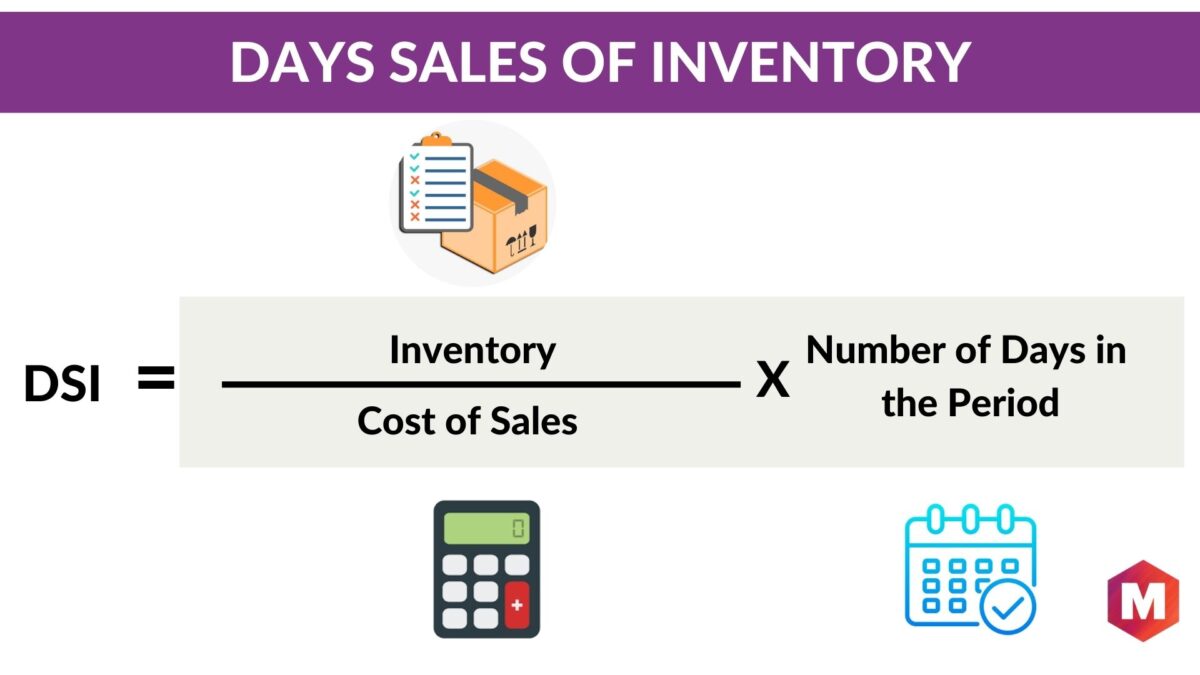

The Days Sales in Inventory Formula

The Days Sales in Inventory formula is relatively simple and can be calculated using the following equation: DSI=Average InventoryCost of Goods Sold (COGS)×365\text{DSI} = \frac{\text{Average Inventory}}{\text{Cost of Goods Sold (COGS)}} \times 365DSI=Cost of Goods Sold (COGS)Average Inventory×365

Where:

- Average Inventory is calculated by adding the beginning inventory and ending inventory for a period and dividing by 2.

- Cost of Goods Sold (COGS) refers to the total cost of producing goods that were sold during the period.

Why is the Days Sales in Inventory Formula Important?

The Days Sales in Inventory formula is important because it helps businesses measure how effectively their inventory is being managed. This can directly influence a company’s liquidity and profitability. Let’s break down why this formula is so vital:

- Inventory Efficiency: The formula helps companies gauge the efficiency with which their inventory is being sold and replaced. A lower DSI implies faster sales, while a higher DSI can signal overstocking or slow-moving products.

- Cash Flow Management: Efficient inventory management reduces the risk of overstocking, which ties up capital. By using the Days Sales in Inventory formula, businesses can manage cash flow better, ensuring that money isn’t unnecessarily locked into unsold inventory.

- Strategic Decision-Making: A high DSI may indicate that a company should reduce its purchasing or improve its marketing to accelerate sales. On the other hand, a low DSI could mean that the company needs to scale up its inventory to meet demand.

How to Calculate Days Sales in Inventory

Step 1: Determine Average Inventory

To find the average inventory, you need to use the formula:Average Inventory=Beginning Inventory+Ending Inventory2\text{Average Inventory} = \frac{\text{Beginning Inventory} + \text{Ending Inventory}}{2}Average Inventory=2Beginning Inventory+Ending Inventory

For example, if a company’s beginning inventory is $100,000 and the ending inventory is $120,000, the average inventory would be: Average Inventory=100,000+120,0002=110,000\text{Average Inventory} = \frac{100,000 + 120,000}{2} = 110,000Average Inventory=2100,000+120,000=110,000

Step 2: Find the Cost of Goods Sold (COGS)

The Cost of Goods Sold (COGS) represents the direct costs associated with producing or purchasing the goods that were sold during a given period. If the COGS for the year is $450,000, we can proceed to the next step.

Step 3: Apply the day sales in Inventory Formula

Now, we apply the formula:DSI=110,000450,000×365=89.33 days\text{DSI} = \frac{110,000}{450,000} \times 365 = 89.33 \text{ days}DSI=450,000110,000×365=89.33 days

This means it takes the company, on average, 89.33 days to sell its entire inventory.

Factors Affecting Days Sales in Inventory

While the Days Sales in Inventory formula is straightforward, several factors can impact the DSI of a company:

- Industry Type: Different industries have varying norms for inventory turnover. For instance, fast-moving consumer goods (FMCG) companies often have a lower DSI compared to luxury goods or electronics companies, which tend to have higher DSI due to slower sales.

- Product Type: The type of products being sold also affects DSI. Perishable goods like food items typically have a much lower DSI compared to durable goods like furniture or electronics.

- Economic Conditions: A recession or downturn can lead to slower sales, which would increase the DSI. Conversely, during periods of economic growth, inventory may move more quickly, resulting in a lower DSI.

- Seasonality: Certain businesses experience seasonal spikes in sales, such as retail stores during the holiday season. This can cause fluctuations in DSI, as inventory moves more quickly during peak periods.

How to Use the Days Sales in Inventory Metric

Understanding and applying the Days Sales in Inventory formula is only the first step. To make the most of this metric, companies should use it strategically:

- Benchmarking Against Industry Standards: Compare your DSI with industry averages to gauge how well your inventory is performing. If your DSI is significantly higher than the industry average, you might need to assess your sales or inventory management practices.

- Monitor Over Time: Track your DSI over multiple periods to identify trends. A rising DSI over time may indicate a problem with sales or purchasing decisions, while a decreasing DSI shows improved inventory efficiency.

- Integrate with Other Metrics: The DSI should not be looked at in isolation. Integrate it with other financial metrics, such as inventory turnover ratio and days payable outstanding, to get a more comprehensive understanding of your business’s financial health.

Conclusion

The Days Sales in Inventory formula is a simple yet powerful tool for understanding how well a company manages its inventory. By calculating DSI, businesses can evaluate their operational efficiency, improve cash flow, and make informed decisions about purchasing, sales, and inventory management. Monitoring and acting on DSI figures regularly can help businesses reduce costs, optimize stock levels, and ultimately improve profitability. Whether you are a small business owner or a large enterprise, incorporating this formula into your financial analysis will enable you to make more data-driven, strategic decisions.

In today’s competitive market, understanding your inventory and how quickly it turns over can set you apart from your competitors. Use the Days Sales in Inventory formula to stay on top of your inventory management and ensure that your business runs as efficiently as possible.